In the autumn of 1929 came the catastrophe which so few had anticipated but which in retrospect seems inevitable--prices broke on the New York Stock Exchange, dragging down with them in their fall, first the economy of the United States itself, subsequently that of Europe and the rest of the world. Financial losses of such magnitude had never before been known in the history of capitalist society, and the ensuing depression was also unprecedented in scope.

There had always been business crises; economists had come to take them as normal and even to chart a certain regularity in their occurrence. But this one dwarfed all its predecessors: no previous depression had remotely approached it in length, in depth, and in the universality of impact. Small wonder that countless people were led to speculate whether the final collapse of capitalism itself, so long predicted by the Marxists, was not at last in sight.

On October 24, "Black Thursday," nearly thirteen million dollars worth of stocks were sold in panic, and in the next three weeks the general industrial index of the New York Stock Exchange fell by more than half. Nevertheless, it was by no means clear at first, how severe the depression was going to be. Previous crises had originated in the United States--this was not the great novelty. What was unprecedented was the extent of European economic dependence on America which the crash of 1929 revealed.

This dependence varied greatly from country to country. Central Europe was involved first, as American financiers began to call in their short-term loans in Germany and Austria. Throughout 1930 these withdrawals of capital continued, until in May, 1931, the Austrian Creditanstalt suspended payments entirely. Thereafter, panic swept the Central European exchanges as bank after bank closed down and one industry after another began to reduce production and lay off workers.

Law, Legal, Finance and Social Issues

Finance, Debt, Credit, Loan, Tax, Mortgage, Divorce, Law...

Social Roles

The hypotheses suggested in the preceding chapter must be tested and developed by reference to case studies of human cultures. But which ones shall we choose? The comparative method yields data both from subcultures within a given cultural area and from distinct cultural wholes. As an example of the former we might compare Virginians with Kansans; as an example of the latter, Hopi Indians with the Ba Thonga of East Africa. Though both methods are feasible, the latter will serve our purpose better.

Data already in hand from interviews, questionnaires, clinical records, and historical and sociological descriptions, indicate gross differences in ego and in attitudes in different ethnic and religious groups within the rather uniform culture area of the United States; but these studies have two great limitations in relation to our present problem:

(1) They cannot at present accurately trace the diffusion of attitude from one group to another within the larger culture. At any given time the attitudes appearing in a subcultural group may be expressions of its own situation or expressions infiltrating from another subcultural area. Historical methods of a quantitative character would have to be devised to meet this difficulty.

(2) They cannot adequately take account of cultural lag. Ego formations or ego attitudes discovered in a given context of cultural events may reflect a situation which existed some time before but has ceased to exist; the persisting expressions of lag may be either stable anachronisms, or moribund vestiges which are doomed to disappear in time. Their true relation to the subcultural situation as it is at present is indeed obscure.

Data already in hand from interviews, questionnaires, clinical records, and historical and sociological descriptions, indicate gross differences in ego and in attitudes in different ethnic and religious groups within the rather uniform culture area of the United States; but these studies have two great limitations in relation to our present problem:

(1) They cannot at present accurately trace the diffusion of attitude from one group to another within the larger culture. At any given time the attitudes appearing in a subcultural group may be expressions of its own situation or expressions infiltrating from another subcultural area. Historical methods of a quantitative character would have to be devised to meet this difficulty.

(2) They cannot adequately take account of cultural lag. Ego formations or ego attitudes discovered in a given context of cultural events may reflect a situation which existed some time before but has ceased to exist; the persisting expressions of lag may be either stable anachronisms, or moribund vestiges which are doomed to disappear in time. Their true relation to the subcultural situation as it is at present is indeed obscure.

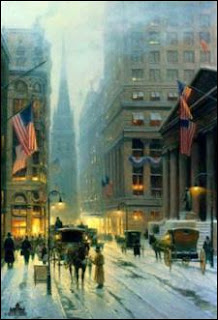

New York City After Great Depression

The effects of depression and war reduced both the physical glamor and the prestige and self-confidence of the glittering giant of the twenties. Only at the mid-century, when an economic upswing prompted large-scale new construction, and the location of the United Nations in the metropolis underlined New York's position as a world capital, did the city's dynamism exert again its customary spell.

The impact of the depression engrossed the attention of commentators of the thirties, especially between 1931 and 1935. Queues of unemployed; men, obviously of good background, selling apples at the street corners; the destitute sleeping in Central Park--sights such as these convinced European visitors that reputedly invincible New York had been harder hit by the crisis than many parts of Europe. They noted the seeming paralysis at the wharves, the stores for rent and sales at broad reductions, the half-empty skyscrapers-"tombstones of capitalism . . . with windows," as one observer wrote, referring to the R.C.A. Building which was rising skyward in the thirties. On a Saturday night in 1931, a French visitor counted less than 300 spectators at the Roxy theatre, where "a year ago . . . it was necessary to stand in line an hour" for one of its 3,000 seats.

The impact of the depression engrossed the attention of commentators of the thirties, especially between 1931 and 1935. Queues of unemployed; men, obviously of good background, selling apples at the street corners; the destitute sleeping in Central Park--sights such as these convinced European visitors that reputedly invincible New York had been harder hit by the crisis than many parts of Europe. They noted the seeming paralysis at the wharves, the stores for rent and sales at broad reductions, the half-empty skyscrapers-"tombstones of capitalism . . . with windows," as one observer wrote, referring to the R.C.A. Building which was rising skyward in the thirties. On a Saturday night in 1931, a French visitor counted less than 300 spectators at the Roxy theatre, where "a year ago . . . it was necessary to stand in line an hour" for one of its 3,000 seats.

Tendencies Which Retard Changes in Spending and in Prices

The tendencies we are to consider which slow down or temporarily reverse a change of spending obviously give no security against a gradual attrition of the dollar and no final security against panicky inflation. Nor do they guarantee that we shall not have a decline in demand to the point of disaster. But they do increase the latitude within which monetary policy can operate without producing results that are too obviously objectionable.

The average person in a healthy economy believes that, basically, economic conditions will not change sufficiently to warrant a radical alteration in his standards of business judgment in the immediate future. If he is thinking of buying certain shares, he will not buy them quite regardless of price. When the cost of building rises, some people go ahead and build anyhow, but some drop out. Most business firms in the market for additional labor and raw materials do not stubbornly insist on buying their planned quota without regard to cost; they may postpone their purchases, or they may use substitutes. If there were not a great deal of give and take and flexibility of plans, it would be hard to see how we could have a well-integrated cost-price structure or a reasonably stable general level of prices. Changes in demand in particular sectors would break up workable price relationships, and a general increase of demand would be self-aggravating and explosive.

The increase of production that generally occurs during a period of increased spending also serves as a stabilizing factor. During the period 1940-43 industrial production more than doubled. Even after the slack has been taken up in the labor supply, the rapid increase of new plant and equipment applying the latest scientific and engineering developments makes possible a further rapid growth of output. Traditionally, new investment has been held to such a low yearly average level that we are just beginning to grasp what a continued high level of investment in industrial research and equipment can do.

The average person in a healthy economy believes that, basically, economic conditions will not change sufficiently to warrant a radical alteration in his standards of business judgment in the immediate future. If he is thinking of buying certain shares, he will not buy them quite regardless of price. When the cost of building rises, some people go ahead and build anyhow, but some drop out. Most business firms in the market for additional labor and raw materials do not stubbornly insist on buying their planned quota without regard to cost; they may postpone their purchases, or they may use substitutes. If there were not a great deal of give and take and flexibility of plans, it would be hard to see how we could have a well-integrated cost-price structure or a reasonably stable general level of prices. Changes in demand in particular sectors would break up workable price relationships, and a general increase of demand would be self-aggravating and explosive.

The increase of production that generally occurs during a period of increased spending also serves as a stabilizing factor. During the period 1940-43 industrial production more than doubled. Even after the slack has been taken up in the labor supply, the rapid increase of new plant and equipment applying the latest scientific and engineering developments makes possible a further rapid growth of output. Traditionally, new investment has been held to such a low yearly average level that we are just beginning to grasp what a continued high level of investment in industrial research and equipment can do.

A Change in the Attractiveness of Debt Instruments Relative to Other Assets

The monetary authorities by varying the conditions of liquidity can determine the level of rates in the short-term money market and gradually have an important impact on rates in all sectors of the debt structure. Rates on particular classes of debts reflect a great variety of factors. For instance, they reflect the supposed risk involved, special tax considerations, the portfolio preferences of the public in relation to the volume of debts in the various sectors, the degree of competition in the area concerned, the cost of making the loan, and the like. Some debts are especially attractive because they serve as good substitutes for money, and their yields ordinarily reflect that fact in an obvious way. Long-term rates reflect a forecast of future conditions in the money market rather than conditions existing at the moment.

The monetary authorities do not necessarily have some definite level of money rates or bond yields they are trying to make effective, but they generally have limits of tolerance for short rates at least. At a given time there is usually a range of rates which they would regard as consistent with their economic goals, even though they have not decided in advance what the limits of the range would be. Although they largely reject rates as gauges of the monetary pressure they are exerting, they nevertheless have a dominating influence on rates through setting the terms and conditions under which money may be created. For instance, they may have as an immediate goal a net borrowed reserve position for the banks of 600 millions; but the rate level which results from that position at that time is attributable to monetary administration just as truly as though the authorities had deliberately sought that level.

The monetary authorities do not necessarily have some definite level of money rates or bond yields they are trying to make effective, but they generally have limits of tolerance for short rates at least. At a given time there is usually a range of rates which they would regard as consistent with their economic goals, even though they have not decided in advance what the limits of the range would be. Although they largely reject rates as gauges of the monetary pressure they are exerting, they nevertheless have a dominating influence on rates through setting the terms and conditions under which money may be created. For instance, they may have as an immediate goal a net borrowed reserve position for the banks of 600 millions; but the rate level which results from that position at that time is attributable to monetary administration just as truly as though the authorities had deliberately sought that level.

How Money Influences the Rate of Spending

The level of spending and the cost-price structure are not determined statically by certain specifiable magnitudes existing at a moment. An economy is a living thing. What it does is current history and largely a product of recent history, though the impact of events may skip over time in an uneven way. In dealing with practical situations we are well aware of this continuity. We know that people go to work in the morning, spending money to get there, because they have a job. They buy food, clothes, and things for the house, see the doctor, engage to make payments for a house and a car, and the like on the basis of the income they have been getting and expect to get. They make financial investments on this basis too, and sometimes direct investments in buildings, improvements, or equipment. Receiving and spending money in a particular pattern is literally a mode of life with them.

Those who run businesses also have a routine. They have established trade and financial connections and a regular working force. They take for granted that certain basic conditions in the economy will remain very much the same in the immediate future--for instance, consumer spending behavior, the pattern of price relationships, and the general state of business. The sales they expect to make are the main reason for their outlay. Money that is coming in and expected to come in serves both as a profit motive and as a means of making further outlay. As is well known, outlay for capital expansion by business corporations is strongly influenced by their cash flow. This is true also of the capital outlay of small businesses and farmers. The rate of spending is influenced both by the prospect of profits and by the desire to maintain a workable relationship between money receipts and outlay. In deciding what to do on both counts, people are guided by recent experience, and so they make the immediate future somewhat of a reflection, though not an exact image, of the recent past.

Those who run businesses also have a routine. They have established trade and financial connections and a regular working force. They take for granted that certain basic conditions in the economy will remain very much the same in the immediate future--for instance, consumer spending behavior, the pattern of price relationships, and the general state of business. The sales they expect to make are the main reason for their outlay. Money that is coming in and expected to come in serves both as a profit motive and as a means of making further outlay. As is well known, outlay for capital expansion by business corporations is strongly influenced by their cash flow. This is true also of the capital outlay of small businesses and farmers. The rate of spending is influenced both by the prospect of profits and by the desire to maintain a workable relationship between money receipts and outlay. In deciding what to do on both counts, people are guided by recent experience, and so they make the immediate future somewhat of a reflection, though not an exact image, of the recent past.

Findings of the Business Advisory Council

In 1952, the Secretary of Commerce announced the findings of the Business Advisory Council that had studied the antitrust laws to determine the relationship between existing statutes and administrative procedures and public interest. Some of the key points of this report as they relate to competition are summarized below.

To uphold competition was presented as the primary concern of antitrust policy. The Council agreed with the principle of economic freedom as expressed in the Sherman Act, but suggested room for improvement in antitrust policy, interpretation, and administration. The basic problem centered around the inconsistencies between various antitrust statutes themselves and around their various interpretations. Judicial opinions have been widely divergent. The inconsistencies, in turn, create a great deal of confusion for the businessman who cannot be certain whether he is abiding by, or violating, the laws.

The realm of the kind of competition creates uncertainties. Some of the interpretations require "hard" competition so that any easing or lessening of price competition, regardless of the consequences in the industry, is forbidden. Yet, other statutes, such as the Robinson-Patman Act, call for the "soft" competition which rules out price reductions if they injure competitors, although they may otherwise be acceptable to consumer welfare. A potentially unifying force in interpreting the antitrust laws is the Rule of Reason, which is applied where questionable practices are deemed to be reasonable and, consequently, acceptable. Even here problems arise because there are few explicit standards that determine what is or is not reasonable. In fact, some statutes specifically bar the application of the Rule of Reason. Because of the Rule's greater flexibility and opportunity for a "caseby-case" approach, its application is generally favored by businessmen.

To uphold competition was presented as the primary concern of antitrust policy. The Council agreed with the principle of economic freedom as expressed in the Sherman Act, but suggested room for improvement in antitrust policy, interpretation, and administration. The basic problem centered around the inconsistencies between various antitrust statutes themselves and around their various interpretations. Judicial opinions have been widely divergent. The inconsistencies, in turn, create a great deal of confusion for the businessman who cannot be certain whether he is abiding by, or violating, the laws.

The realm of the kind of competition creates uncertainties. Some of the interpretations require "hard" competition so that any easing or lessening of price competition, regardless of the consequences in the industry, is forbidden. Yet, other statutes, such as the Robinson-Patman Act, call for the "soft" competition which rules out price reductions if they injure competitors, although they may otherwise be acceptable to consumer welfare. A potentially unifying force in interpreting the antitrust laws is the Rule of Reason, which is applied where questionable practices are deemed to be reasonable and, consequently, acceptable. Even here problems arise because there are few explicit standards that determine what is or is not reasonable. In fact, some statutes specifically bar the application of the Rule of Reason. Because of the Rule's greater flexibility and opportunity for a "caseby-case" approach, its application is generally favored by businessmen.

Subscribe to:

Posts (Atom)